How Stablecoins Address Volatility?

Crypto ecosystem is well known for hacking, bump and dumps, market manipulations and regulation troubles. Adding to this, bad projects or lack of delivery technology on time or as promised, this is kind of “too much” for newcomers. This volatility is the biggest barrier to an investor’s adoption. How could you possibly use an unstable currency for the transaction that will impact buyers, merchants, traders, and financial institutions?

With cryptos like BTC or ETH or LTC, certainly not.

The answer is apparently Stablecoins in a form of digital money, imitating traditional and stable currency such as but not limited to, USD — or a commodity — and, “should be” guaranteed to exchange 1:1 Stablecoins for its underlying asset.

Stablecoins were created to be used in the way cryptocurrencies were intended for transactions: User- friendly, stabilized, scalable, and secured. A functional and viable characteristic to increase adoption and facilitate a valuable startup growth in the ecosystem. In a few words, a critical role.

JP Morgan applied this principle by “linking” the JP Coin with the dollar. The idea is to make the digital payments more accessible and efficient, without the fear of wild swings of traditional cryptocurrency, and tremendously reduce the operation cost (We are not sure that the customers will get the advantage of it..). Refer to my article on how the bank is adopting this technology on this link.

Another example is in Venezuela where the Petro Cryptocurrency was created and pegged to the barrel of oil.

After governments, banks, and startups, now it’s the turn of huge corporations, such as Facebook, Google and most recently, IBM. It is too soon to see how they will manage it and what will be the exact consequences for the users.

Are Stablecoins The Answer To Crypto’s Volatility Problem?

To answer this question, let’s see first what they are capable to do and what are their limitations.

Fiat-Collateralized Stablecoins

Fiat collateralized Stablecoins are being backed by fiat reserves such as USD, EUR, etc.

Example: USDT (1 Tether 1:1 USD) or Digix back by gold (1g of gold against 1 DGX)

TrueUSD: Transparency through regular audits fully backed collateral, and fulfilled legal requirements for the USD-peg.

Pros: Efficient, simple, stable and less vulnerable to hack

Cons: Centralized — Need a trusted custodian to store the fiat — Expensive and slow liquidation into fiat –

Highly regulated — Need audits to ensure transparency as not decentralized.

Crypto-Collateralized Stablecoins

Stablecoin is backed by other crypto-currencies, volatility problem remains but the collateralized property with another crypto presents a guarantee to absorb price variation to some extent…If the market crashes, you are under collateralized crypto and your stablecoin is destabilized losing also value. Some are using a group of token to back the stablecoin to minimize the market volatility but this will not guarantee reserve from dropping. To counterbalance this problem, the coin will not have a 1:1 ratio towards the collateral crypto, it will look more like $2 USD pledge for every $1 USD stablecoin issued. We call it over-collateralization.

Example:

MakerDAO leverages Ethereum using a smart contract and the Ether collateral gathers into something called a Pooled Ether (PETH), which allows the smart contract to generate MakerDAO’s (DAI) token and interest over time. The interest gained is called the “stability fee” which means that users will need to pay back the same amount of DAI if they want to withdraw Ether from the contract.

Pros: Decentralized as backed by crypto-currency, better liquidity access and more transparent (Everyone has access to the collateralization ration of the stablecoin)

Cons: Less stable than fiat, can auto liquidate when underlying collateral crash. Tied to the global market value of a cryptocurrency basket, complex and inefficient use of capital (Go to this link to know more)

Non-Collateralized Stablecoins

Stablecoin is backed by itself in a specific given time. This model uses an autonomous algorithm that can be a smart contract controlling the coin supply. Based on the demand, the algorithm will automatically change the token supply to keep the price stable.

Example: Basis projects the token to an index-offering, wherein Basis will aim to ensure its stability by pegging its value to a multitude of assets. Further to this, the project is hoping to leverage two other currencies in a bid to maintain its supply. Token holders can sell their tokens for bonds to gather interest over time on their investment, and Basecoin Shares are issued when the stablecoin’s supply must be expanded.

Pros: Decentralized and independent, no collateral required.

Cons: Need a continuous growth, sensitive to the crypto market, and cannot be liquidated during a crash, complexity and difficult to analyze how safe it is.

Hybrid Stable Coin Models

It combines Asset and Non-Collateralized which gives them the advantages of each category and covers a lot of needs. However, it collects all the cons and I do not recommend this one as it is too complex.

Examples:

Reserve, Saga, Aurora — Borea

Pros: Mixes all the advantages of each category and cover a lot of needs for different users

Cons: complex as it crosses different categories of backed assets. Gather all the risks, high regulation risk

How Can Investors Protect Themselves From Worst-Case Stablecoin Scenario?

At this point in time, it is too early to say if the technology is going to work. Close analyzing of Stablecoin versus investor/user needs would be the best to select the right Stablecoin and create a Stablecoin portfolio to minimize the risk.

We have to keep in mind that Stablecoin are more like payment coin, a medium of exchange to avoid volatility during a transaction, a store of value and unit of account. Still imperfection with technological problems to resolve such as Oracle and its own stability challenge (except for those with really scarce backed by asset).

See this link to get a list of the stablecoins. It is basically a trade-off to make when you select a stablecoin only to “minimize” your risk.

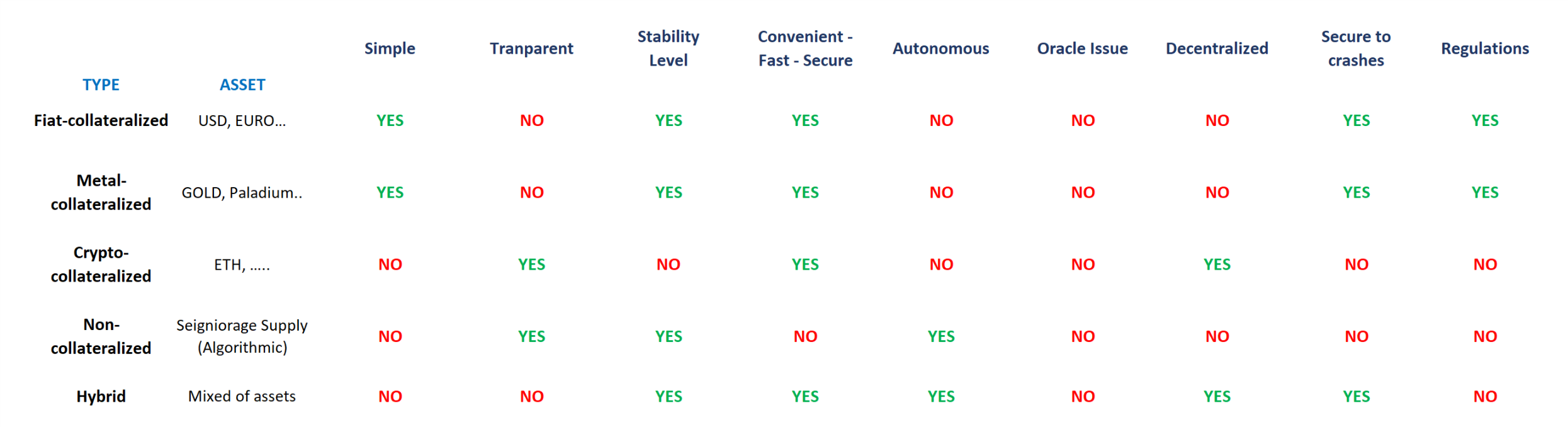

In the worst case scenario. The answer is in their features and what is behind it. Here, below. A recap tab of some major characteristic points for each type of stablecoin.

A smart checklist to follow-up before any selection would be the best approach in early Stablecoins market:

· Check the asset-backed

· How stable is the asset backing it?

· Control in place to ensure that the stablecoin has enough of the assets in the reserve.

· What is the security/reserve audit?

· For reserve-backed stablecoins, assess the counterpart risk (If you can)

· Whitepaper quality and content. An unclear document is like a smoke grenade.

· Team information: LinkedIn profiles, other profiles, advisory teams, partners, etc.

“Stablecoin will not bring stability in market but will support adoption”

The reason is simple: The stablecoin role is designed to stabilize ONLY its own value, NOT the crypto market and, the story shows that even stablecoins are NOT stable (see Nubits story)

See article: https://www.ccn.com/binance-stablecoin-first-hurt-tethers-dominance

“Stablecoins make sense if they are really stable, decentralized, audited and regulated, bringing adoption in the market”.

So far, Tether is probably the best example of a modern working stablecoin.

According to a report released by Diar, Tether’s on-chain transaction volume, meaning the volume of the stablecoin on blockchain networks achieved a new all-time high for 2019.

It is a catalyzer that brings adoptions. According to a report released by Diar, China accounts for 60 percent of Tether volume. “On-chain data shows Tether movements hitting a new all-time high for 2Q19 with one month left on the calendar for the period. What is most striking, however, is the volume coming in and out of Chinese exchanges dwarfs western and global trading venues and accounts for more than half of the total transaction value of known parties”.

Considering this report, it will be really hard for the newcomers to compete against Tether by issuing a USD-backed stablecoin to build a new user base for a new product.

Stablecoins And Regulation

In the case of the stablecoins backed by cryptocurrencies, regulations will have to work hard… clarify the terms, legal cases to refer. The equation will be difficult to resolve as they will take into account the credibility of the issuer, collateral nature, security, bugs, blockchain platform…

If the stablecoin is not anchored to a scarce asset (such as gold) there is also a substantial danger of a constant decrease in the value of the stablecoin itself, due to its collateral. Regulation, in this case, will be more difficult to apply as per its collateral nature and the technology behind it.

In another hand, in the case of a stablecoin that is backed by gold or USD, the token value will have more chance to be stable and the government will easily regulate commodities (Gold or USD). It’s no surprise why Tether has so much success.

Stable Coin Are Proliferating

See the referral link here.

Final Thoughts

It is too soon today to see what real impact and role stablecoin will have on the crypto ecosystem as the technology is fairly new, the technical challenges are not yet overcome and the regulation is still struggling to implement rules with the standard Bitcoin and Altcoins. It is more than certain that some other Stablecoins will disappear due to regulation effect, technical and features limitation.